What are the differences between term life insurance and whole life insurance? Choosing the right life insurance can feel like navigating a maze, especially when faced with the seemingly endless options. This guide cuts through the jargon, comparing term and whole life policies head-to-head, helping you understand the key differences in premiums, coverage, cash value, and long-term financial implications.

We’ll break down the complexities, offering clear explanations and practical examples to empower you to make an informed decision.

From the initial cost to the duration of coverage and the potential for cash value accumulation, we’ll explore the nuances of each policy type. Whether you’re a young professional just starting out or a retiree looking for peace of mind, understanding these differences is crucial for securing your financial future and protecting your loved ones. We’ll even look at how your age, financial goals, and risk tolerance influence which type of insurance best suits your needs.

Premiums and Costs

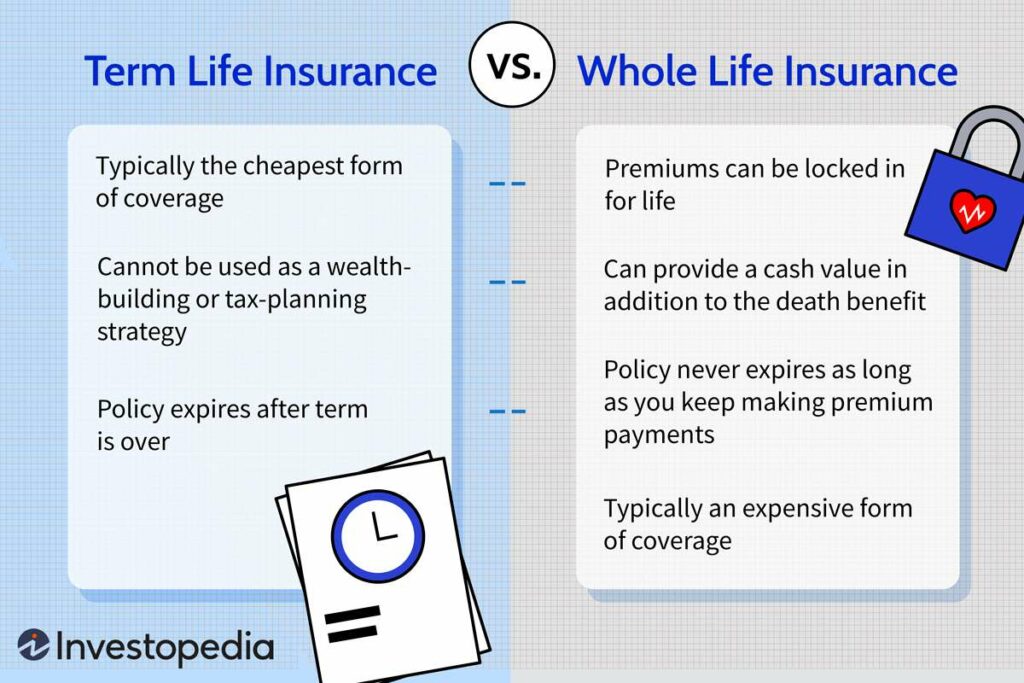

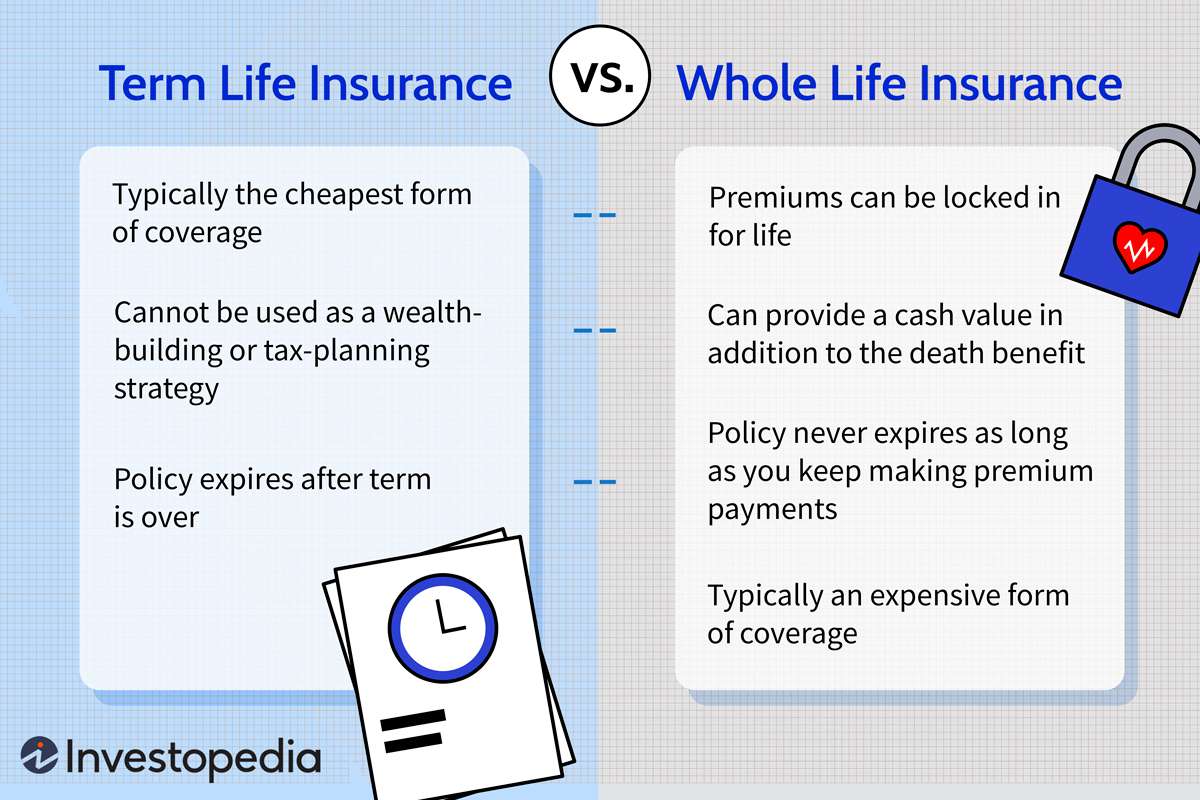

Choosing between term and whole life insurance often boils down to the cost. Both offer death benefit protection, but their premium structures and overall expenses differ significantly, impacting your long-term financial planning. Understanding these differences is crucial for making an informed decision.Let’s dive into a comparison of the premium structures and the factors influencing the cost of each type of insurance.

So, you’re wondering about term life vs. whole life insurance? The main difference lies in coverage duration: term is temporary, whole is lifelong. But a crucial factor impacting your eligibility for any life insurance, regardless of the type, is your health. Check out this article if you have a pre-existing condition: can I get life insurance if I have a pre existing medical condition.

Understanding this aspect is key before deciding between the longer-term financial commitment of whole life or the more budget-friendly approach of term life insurance.

Premium Structures

Term life insurance premiums are typically much lower than whole life insurance premiums. This is because term life insurance only provides coverage for a specific period (the term), while whole life insurance offers lifelong coverage. Term life insurance premiums remain level for the duration of the policy’s term. However, when the term expires, you’ll need to renew the policy (often at a higher rate reflecting your increased age) or let the coverage lapse.

Whole life insurance premiums, on the other hand, remain level for the life of the policy, providing consistent coverage without the need for renewal. However, these premiums are considerably higher than term life premiums.

Factors Influencing Insurance Costs

Several factors influence the cost of both term and whole life insurance. Your age is a major determinant; younger individuals generally qualify for lower premiums due to their statistically lower risk of death. Your health status plays a crucial role; applicants with pre-existing conditions or unhealthy lifestyle choices might face higher premiums or even be denied coverage. The amount of coverage you seek directly impacts the cost – a larger death benefit will naturally result in higher premiums.

Finally, policy features such as riders (additional benefits) can add to the overall cost. For instance, adding a disability waiver rider to either policy will increase the premium.

Hypothetical Premium Comparison

To illustrate the premium differences, let’s consider a hypothetical example of a 35-year-old male seeking $500,000 in coverage. The actual premiums will vary depending on the insurer, health status, and specific policy features. This example provides a general comparison.

| Policy Type | Premium (Annual) | Premium (Monthly) | Total Premium Paid Over 20 Years |

|---|---|---|---|

| 20-Year Term Life | $500 | $42 | $10,000 |

| Whole Life | $2,500 | $208 | $50,000 |

*Note: These figures are purely hypothetical and for illustrative purposes only. Actual premiums will vary significantly depending on the insurer, the applicant’s health, and other factors.*

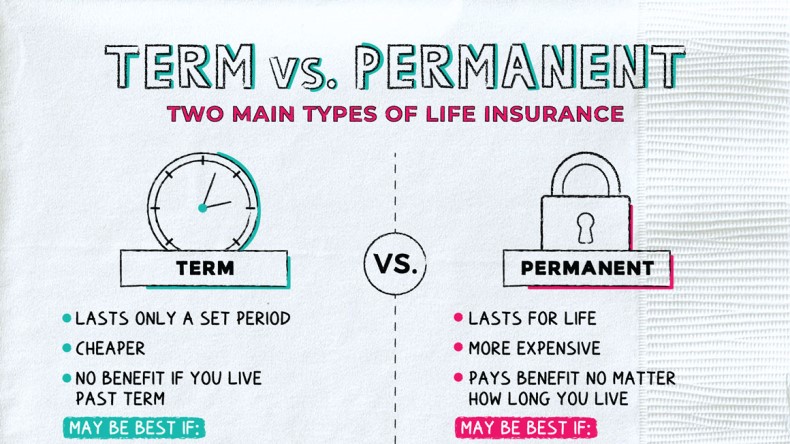

Coverage Duration

Choosing between term and whole life insurance hinges significantly on your desired coverage duration. Understanding the differences is crucial for making an informed decision that aligns with your financial goals and family’s needs. Both offer crucial protection, but their approach to coverage length differs dramatically.The core distinction lies in the timeframe the policy provides coverage. Term life insurance offers coverage for a specified period, or “term,” ranging from a few years to 30 years or more.

Whole life insurance, on the other hand, provides coverage for your entire lifetime, as long as premiums are paid.

Term Life Insurance Coverage Duration, What are the differences between term life insurance and whole life insurance

The length of your term life insurance policy is a critical factor influencing both your premiums and the overall cost-effectiveness. Shorter terms, such as 10 or 20 years, typically result in lower premiums, making them more affordable in the short term. However, this comes at the cost of limited coverage. If you need coverage beyond the chosen term, you’ll need to renew the policy, often at a significantly higher rate due to your increased age, or purchase a new policy altogether.

Conversely, longer-term policies, like 30-year terms, offer broader coverage but come with higher premiums. Choosing the right term length requires careful consideration of your life stage, financial responsibilities (like mortgage payments or children’s education), and long-term financial planning. For example, a young family might opt for a 20- or 30-year term to cover their mortgage and children’s upbringing, while an older individual with fewer financial obligations might choose a shorter term.

Understanding the difference between term life insurance (temporary coverage) and whole life insurance (lifetime coverage) is crucial for financial planning. Similarly, choosing the right travel insurance is vital, especially for adventurous backpacking trips; check out this guide on how to choose the right travel insurance for backpacking trips to ensure you’re protected. Just like with life insurance, assessing your needs and budget is key before committing to a policy, whether it’s for your life or your travels.

Whole Life Insurance Coverage Duration

Whole life insurance offers lifetime coverage, providing financial protection for your beneficiaries as long as you maintain the policy. This “lifetime coverage” aspect is a significant advantage, eliminating the risk of the policy expiring before you no longer need the protection. However, this comprehensive coverage comes at a much higher cost compared to term life insurance. Premiums for whole life insurance are generally significantly higher and remain constant throughout your life, creating a long-term financial commitment.

While the premiums are consistent, the policy’s cash value component also grows over time, potentially offering a source of funds for retirement or other financial needs. This growth, however, is usually slow and can be impacted by the market. For instance, a person planning for long-term financial security for their family and wanting a safety net even after retirement might choose whole life insurance.

Cash Value Accumulation

Term life insurance and whole life insurance differ significantly in their approach to cash value accumulation. Understanding these differences is crucial for choosing the policy that best aligns with your financial goals. While term life insurance focuses solely on providing death benefit coverage for a specified period, whole life insurance incorporates a cash value component that grows over time.Whole life insurance policies build cash value, a savings component that grows tax-deferred.

This growth is fueled by a portion of your premiums, and it earns interest over time. In contrast, term life insurance policies do not accumulate cash value; premiums solely pay for the death benefit coverage. The key distinction lies in the investment aspect: whole life offers a built-in savings plan, while term life is purely a death benefit protection product.

Cash Value Growth and Tax Implications

Cash value in a whole life insurance policy grows tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them. The growth rate depends on the policy’s interest rate, which can vary depending on the insurer and the policy’s type. Several factors influence cash value growth, including the policy’s design, the insurer’s investment performance, and the premiums paid.

For example, a whole life policy with a higher premium might accumulate cash value faster than one with a lower premium, assuming similar interest rates and policy designs. However, it’s crucial to understand that the growth is not guaranteed and may be subject to market fluctuations, depending on the underlying investment strategy of the insurance company. When you withdraw cash value, you’ll generally only pay taxes on the earnings portion, not on the original premiums you contributed.

Early withdrawals may also incur penalties, depending on the policy’s terms. Conversely, term life insurance offers no such cash value accumulation or tax implications related to cash value growth, as it does not include a cash value component.

Circumstances Where Cash Value is Beneficial

Cash value can be advantageous in specific financial situations. For instance, it can serve as a source of funds for emergencies, supplementing retirement income, or financing education expenses. The ability to borrow against the cash value without surrendering the policy provides flexibility. Imagine needing funds for a significant home repair or a child’s unexpected medical bills; accessing cash value could be a lifeline.

Similarly, it can be used as a supplemental retirement income stream, offering a tax-advantaged way to access funds in retirement. It’s important to remember that borrowing against the cash value reduces the death benefit and incurs interest charges, so careful planning is crucial. Conversely, term life insurance doesn’t offer this flexibility; it simply provides a death benefit.

The decision of whether or not cash value is beneficial depends entirely on individual financial goals and risk tolerance.

Policy Features and Benefits

Understanding the nuances of policy features and benefits is crucial when deciding between term and whole life insurance. Both offer core death benefit protection, but their additional features and the way benefits are accessed differ significantly. This section will clarify these differences, focusing on riders, death benefit payouts, and loan/surrender options.

Riders and Additional Benefits

Riders are optional add-ons that enhance the base policy’s coverage. Both term and whole life policies can incorporate riders, but the availability and types of riders often vary based on the insurer and the specific policy. Choosing the right riders depends on individual needs and risk profiles.

- Term Life Insurance Riders: Common riders for term life insurance include accidental death benefit riders (paying out a larger sum if death is accidental), waiver of premium riders (waiving premiums if the policyholder becomes disabled), and term conversion riders (allowing conversion to a whole life policy without a medical exam).

- Whole Life Insurance Riders: Whole life insurance often offers a wider array of riders. These can include long-term care riders (covering long-term care expenses), critical illness riders (paying a lump sum upon diagnosis of a critical illness), and guaranteed insurability riders (allowing the purchase of additional coverage at specific life stages without a medical exam). For example, a guaranteed insurability rider could allow a policyholder to increase their coverage amount when they have children, without needing to undergo a new medical evaluation.

Death Benefit Payout

The death benefit is the core promise of any life insurance policy. However, the specifics of the payout differ between term and whole life insurance.

- Term Life Insurance: A term life insurance policy pays out a predetermined death benefit only if the insured dies within the policy’s term. If the insured outlives the term, the policy expires and there is no payout. The death benefit is typically a fixed amount, remaining unchanged throughout the policy’s duration. For example, a $500,000 term life policy will pay out $500,000 upon the death of the insured within the policy term.

- Whole Life Insurance: A whole life insurance policy offers a guaranteed death benefit payable upon the death of the insured, whenever that may occur. The death benefit is usually a fixed amount, but it may grow over time due to the policy’s cash value accumulation. The death benefit can also be adjusted depending on the policy type and available riders.

Loan Options and Policy Surrender Options

Accessing the policy’s value during the policyholder’s lifetime is another key difference.

- Term Life Insurance: Term life insurance policies generally do not offer loan options or cash value. Surrendering the policy typically results in no return of premiums paid.

- Whole Life Insurance: Whole life insurance policies build cash value over time. Policyholders can typically borrow against this cash value, often at a favorable interest rate. Surrendering the policy allows access to the accumulated cash value, although this will reduce the death benefit and may result in tax implications. The surrender value depends on the policy’s age and cash value accumulation.

Suitability for Different Life Stages: What Are The Differences Between Term Life Insurance And Whole Life Insurance

Choosing between term and whole life insurance depends heavily on your current life stage, financial goals, and risk tolerance. Understanding these factors is crucial for making an informed decision that aligns with your long-term financial well-being. This guide helps navigate the complexities of choosing the right life insurance policy based on your life stage.The ideal type of life insurance changes as your circumstances evolve.

Young adults often have different priorities than families with young children or retirees, influencing their need for coverage and financial flexibility. Understanding how your financial goals and risk tolerance interact with these life stages is key to selecting the most appropriate policy.

Life Insurance Suitability by Life Stage

The following guide offers recommendations based on typical life stages, but remember that individual circumstances can vary. Always consult a financial advisor for personalized guidance.

- Young Adults (20s-30s): At this stage, establishing a career and building a financial foundation are often top priorities. Term life insurance is generally a more affordable and practical option. The lower premiums allow for focusing on debt reduction, saving for a down payment on a house, or investing for retirement. The coverage provides peace of mind knowing loved ones would be protected in case of unexpected death, while the lower premiums help manage expenses and save for the future.

- Families with Young Children (30s-40s): This life stage often necessitates higher coverage amounts to protect dependents in the event of the death of a breadwinner. While term life insurance remains a cost-effective choice for large coverage amounts, some families might consider whole life insurance for its cash value accumulation feature. This cash value can serve as a supplementary source of funds for education or other long-term family needs, though it comes at a higher premium cost.

- Retirees (60s and beyond): Once retirement arrives, the need for extensive life insurance coverage might diminish. If the primary financial responsibility to dependents is reduced, term life insurance might no longer be necessary. However, existing whole life insurance policies can provide a valuable source of income during retirement, leveraging the accumulated cash value. This can supplement retirement savings and help manage unexpected expenses.

Financial Goals and Risk Tolerance

Your financial goals significantly influence the choice between term and whole life insurance. Those prioritizing affordability and high coverage for a specific period might opt for term life insurance. Conversely, individuals aiming for long-term savings and wealth accumulation, alongside life insurance, might favor whole life insurance, despite its higher premiums. Risk tolerance also plays a role; those with a higher risk tolerance might invest more aggressively, making term life insurance sufficient, while those with a lower risk tolerance might prefer the stability of whole life insurance’s cash value component.

Long-Term Financial Implications

The long-term financial implications differ considerably. Term life insurance offers cost-effectiveness in the short to medium term, allowing for greater flexibility in allocating resources to other financial goals. However, coverage ceases at the end of the term, requiring renewal or the purchase of a new policy at potentially higher rates. Whole life insurance, while more expensive initially, offers lifelong coverage and cash value accumulation, potentially creating a valuable asset over time.

However, the higher premiums can restrict investment opportunities in other areas. For instance, consistently paying higher premiums for whole life insurance might mean less money available for retirement savings or other investments. A family might choose term insurance to maximize savings for their children’s education, while another might prioritize whole life to ensure a legacy and provide future financial security for heirs.

Illustrative Examples

Choosing between term and whole life insurance depends heavily on individual circumstances and financial goals. Let’s examine how these policies might benefit different life stages.To illustrate the differences, we’ll look at two scenarios: a young professional starting their career and a retiree nearing the end of their life. Understanding their unique needs will highlight the advantages and disadvantages of each insurance type.

Young Professional Scenario

Imagine Anya, a 28-year-old software engineer with a stable job and a young family. Anya needs significant life insurance coverage to protect her family in case of her untimely death, but her budget is tight. Term life insurance is a cost-effective solution for her. The relatively low premiums allow her to secure a substantial death benefit without straining her finances.

However, Anya won’t build any cash value with a term policy. If she needs to access funds later in life, she’ll be unable to do so. Whole life insurance, while offering cash value accumulation, would come with significantly higher premiums, reducing her disposable income for other financial priorities like saving for a down payment on a house or investing in retirement.

For Anya, the advantages of the lower premiums and substantial coverage of term life insurance outweigh the lack of cash value accumulation at this stage of her life.

Retiree Scenario

Consider Ben, a 65-year-old retiree living on a fixed income. Ben’s primary need is less about leaving a large death benefit for his heirs and more about ensuring a safety net for his spouse. He may find whole life insurance more appealing. While premiums remain consistent throughout the life of the policy, the cash value component can provide a source of funds for emergencies or supplementary income during retirement.

This contrasts with term life insurance, which would require him to renew the policy at a much higher rate, or face lapse of coverage at a time when his need for coverage is potentially even greater. For Ben, the consistent premiums and the potential for accessing the cash value outweigh the higher initial cost compared to a term life insurance policy.

Visual Representation of Cash Value Growth

Imagine two graphs side-by-side. The graph on the left represents a term life insurance policy. It shows a flat, horizontal line representing the premium paid each year. The amount remains constant for the duration of the policy term. There is no upward slope, reflecting the absence of cash value accumulation.

In contrast, the graph on the right depicts a whole life insurance policy. It starts with a higher premium than the term policy, but this premium remains consistent. However, the line representing cash value steadily climbs upwards, illustrating the growth of the cash value over time, compounding year after year. The slope of this line reflects the gradual increase in the cash value, showcasing the long-term investment aspect of whole life insurance.

The difference in the overall vertical distance between the two lines at the end of the policy term visually demonstrates the substantial difference in accumulated cash value between the two types of insurance.