How to compare different health insurance plans for families? Navigating the world of family health insurance can feel like deciphering a complex code. Premiums, deductibles, networks – it’s enough to make your head spin! But fear not, fellow parents! This guide breaks down the process into manageable steps, helping you find the best plan for your family’s unique needs and budget.

From understanding your family’s specific healthcare requirements to mastering the art of online comparison tools, we’ll equip you with the knowledge to make an informed decision and secure the peace of mind that comes with comprehensive coverage.

Choosing the right health insurance for your family is a crucial decision impacting your financial well-being and access to quality healthcare. This involves careful consideration of various factors, including premiums, deductibles, co-pays, provider networks, benefits, and additional riders. Understanding these aspects empowers you to compare plans effectively and choose the one that best aligns with your family’s needs and budget.

We’ll walk you through each step, providing practical tips and examples to simplify the process.

Understanding Family Health Insurance Needs

Choosing the right family health insurance plan can feel overwhelming, but understanding your family’s specific needs is the first crucial step. This involves considering various factors to ensure you secure a policy that offers adequate coverage for everyone. A well-informed decision can save you significant stress and financial burden in the long run.Factors influencing the choice of a family health insurance plan are multifaceted and interconnected.

A comprehensive assessment is key to finding the best fit.

Essential Health Insurance Coverage for Families

A typical family’s health insurance needs extend beyond basic medical care. Comprehensive coverage should include hospitalization, surgery, doctor visits, prescription drugs, and potentially preventative care like vaccinations and wellness checkups. Depending on the family’s specific needs and the plan’s offerings, additional coverage for dental, vision, and mental health services might be essential. Consider also the level of coverage – whether it’s a basic plan with high deductibles or a more comprehensive plan with lower out-of-pocket costs.

The right balance depends heavily on the family’s financial situation and their anticipated healthcare utilization.

Factors Influencing Family Health Insurance Plan Selection

Several factors significantly impact the selection of a suitable family health insurance plan. Age plays a critical role, as younger children may require more preventative care, while teenagers might face higher risks associated with sports injuries or other adolescent-related health issues. Pre-existing health conditions within the family also necessitate careful consideration. Families with members suffering from chronic illnesses will require plans offering robust coverage for ongoing treatment and medications.

Lifestyle choices, such as smoking or engaging in high-risk activities, can also influence the cost and type of plan needed. The family’s budget is another major factor. It’s important to balance the level of coverage desired with the affordability of the premiums and out-of-pocket expenses.

Comparing Needs: Young Children vs. Teenagers

The healthcare needs of a family significantly change as children grow. This table highlights the key differences between a family with young children and a family with teenagers.

| Feature | Family with Young Children (Ages 0-5) | Family with Teenagers (Ages 13-19) |

|---|---|---|

| Primary Healthcare Needs | Well-baby visits, vaccinations, common childhood illnesses (ear infections, colds, etc.), potential allergies | Sports injuries, mental health concerns, acne treatment, sexually transmitted infection (STI) screenings, substance abuse prevention |

| Specialized Care Needs | Pediatrician visits, occasional specialist visits (e.g., allergist, dermatologist) | Orthopedic care (sports injuries), mental health professionals (therapists, psychiatrists), gynecologist/urologist visits |

| Prescription Medications | Antibiotics, allergy medications, occasional over-the-counter pain relievers | Acne medications, ADHD medications, birth control, mental health medications |

| Preventive Care | Regular checkups, vaccinations, dental checkups | Annual checkups, STI screenings, mental health checkups, potentially vaccinations (e.g., HPV) |

Comparing Premiums and Deductibles: How To Compare Different Health Insurance Plans For Families

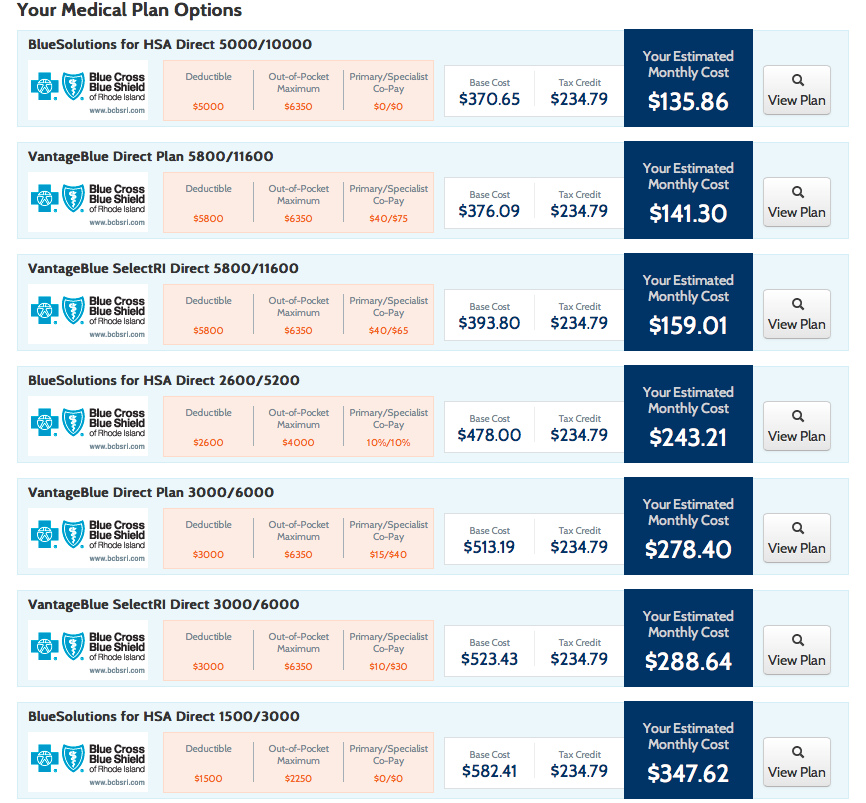

Choosing a family health insurance plan involves navigating a complex landscape of costs. Understanding the nuances of premiums and deductibles is crucial for making an informed decision that aligns with your family’s budget and healthcare needs. This section breaks down these key cost components, helping you compare plans effectively.Premiums and deductibles represent two distinct but interconnected aspects of your health insurance costs.

Premiums are the recurring monthly payments you make to maintain your insurance coverage, regardless of whether you utilize medical services. Deductibles, on the other hand, are the amount you must pay out-of-pocket for covered healthcare services before your insurance coverage kicks in. The interplay between these two factors significantly impacts your overall healthcare expenses.

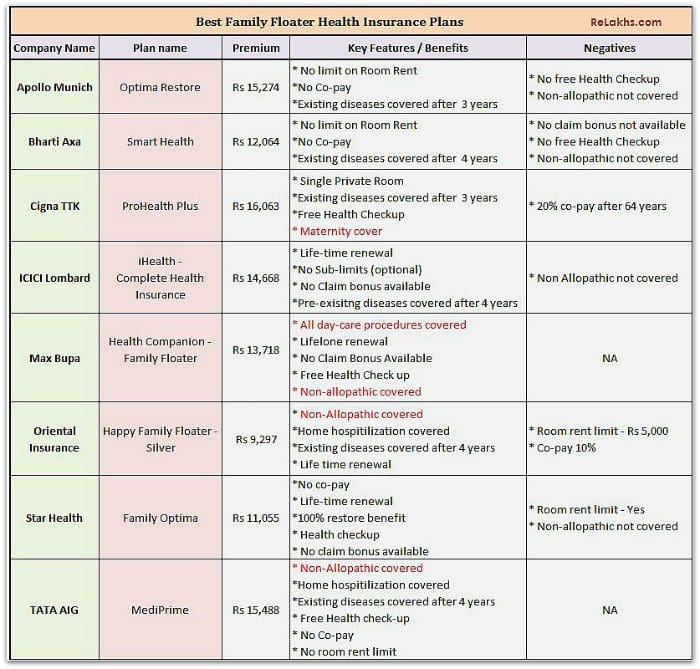

Premium Structures Across Providers

Different insurance providers offer family plans with varying premium structures. These premiums are influenced by factors such as the plan’s coverage level (e.g., bronze, silver, gold, platinum), the number of family members covered, geographic location, and the ages of the individuals covered. For example, a family of four in a high-cost area might see premiums ranging from $1,500 to $3,000 per month depending on the plan’s level of coverage and the insurer.

A bronze plan will generally have lower premiums but higher out-of-pocket costs, while a platinum plan will have higher premiums but lower out-of-pocket costs. Direct comparison of premium quotes from multiple insurers is essential to find the best value.

Variations in Deductibles, Co-pays, and Out-of-Pocket Maximums

Deductibles, co-pays, and out-of-pocket maximums are all crucial components of understanding your potential healthcare costs. The deductible is the amount you pay before your insurance starts covering expenses. Co-pays are fixed amounts you pay for specific services, such as doctor visits, while the out-of-pocket maximum represents the total amount you’ll pay in a year before your insurance covers 100% of covered expenses.Let’s illustrate with examples: Plan A might have a $10,000 family deductible, a $50 co-pay for doctor visits, and a $20,000 out-of-pocket maximum.

Plan B, conversely, could feature a $5,000 family deductible, a $75 co-pay, and a $15,000 out-of-pocket maximum. The choice depends on your risk tolerance and predicted healthcare utilization. A family anticipating significant medical expenses might prefer Plan B despite the higher premiums, while a family expecting minimal healthcare needs might find Plan A more cost-effective.

Long-Term Cost Implications of High-Deductible vs. Low-Deductible Plans

Choosing between a high-deductible and a low-deductible plan has significant long-term cost implications.

- High-Deductible Plan (HDP): Lower monthly premiums, but higher upfront costs. You’ll pay more out-of-pocket before insurance coverage begins. This is suitable for healthy families who anticipate minimal healthcare use. However, a major unexpected illness or injury could lead to substantial out-of-pocket expenses. Consider the potential for a health savings account (HSA) to mitigate costs.

- Low-Deductible Plan (LDP): Higher monthly premiums, but lower out-of-pocket costs when you need care. This offers greater financial protection against unexpected medical bills. It’s a better choice for families with pre-existing conditions, chronic illnesses, or who anticipate regular healthcare visits.

Choosing the right plan depends on your family’s specific health needs and financial situation. Carefully weigh the trade-offs between premiums and out-of-pocket expenses to find the best fit.

Evaluating Provider Networks and Coverage

Choosing a family health insurance plan involves more than just comparing premiums. Understanding your provider network is crucial for ensuring you can access the doctors and specialists you need. A limited network might mean higher out-of-pocket costs or difficulty finding care within your preferred location. This section will guide you through evaluating provider networks and understanding their impact on your healthcare access.

Provider Network Importance and Verification

Your provider network is the group of doctors, hospitals, and other healthcare providers contracted with your insurance company. Seeing in-network providers typically means lower costs for your care. To determine if your preferred doctors are in-network, you can use the insurance company’s online provider directory, which usually allows you to search by name, specialty, or location. You can also contact the insurance company directly or your doctor’s office to confirm their participation in the network.

Failing to verify this beforehand could lead to unexpected high bills. For example, if your pediatrician isn’t in-network, your visits might cost significantly more than anticipated.

Types of Provider Networks

Different health insurance plans offer various types of provider networks, each with its own rules and restrictions. Understanding these differences is vital for selecting a plan that suits your family’s needs and healthcare preferences.

| Network Type | Description | Cost Implications | Flexibility |

|---|---|---|---|

| HMO (Health Maintenance Organization) | Requires choosing a primary care physician (PCP) who manages your care and refers you to specialists. Care is typically only covered if received within the network. | Generally lower premiums, but higher out-of-pocket costs for out-of-network care. | Less flexible; requires referrals for specialist visits. |

| PPO (Preferred Provider Organization) | Allows you to see any doctor, in-network or out-of-network, without a referral. However, seeing in-network providers results in lower costs. | Higher premiums than HMOs, but lower out-of-pocket costs for in-network care. Out-of-network care is covered, but at a higher cost. | More flexible; no referrals needed. |

| POS (Point of Service) | Combines elements of HMO and PPO plans. A PCP manages care, but you can see out-of-network providers for a higher cost. | Premiums fall between HMO and PPO plans. Out-of-network care is covered, but with higher cost-sharing. | More flexible than HMOs, but less flexible than PPOs. |

Analyzing Benefits and Exclusions

Choosing a family health insurance plan involves more than just comparing premiums. A thorough understanding of the benefits offered and any exclusions or limitations is crucial for making an informed decision that protects your family’s health and financial well-being. Failing to analyze these aspects could lead to unexpected out-of-pocket costs during a medical emergency.Understanding the specifics of your coverage is key to avoiding unpleasant surprises.

This section will guide you through analyzing the benefits and exclusions of different family health insurance plans, enabling you to choose the plan that best fits your family’s needs and budget.

Common Benefits Included in Family Health Insurance Plans

Most family health insurance plans include a core set of benefits designed to cover a wide range of healthcare services. These benefits aim to provide comprehensive coverage for various medical needs, reducing the financial burden associated with illness or injury. However, the specifics of these benefits can vary between plans, so careful review is essential.

- Doctor Visits: Routine checkups, specialist visits, and other doctor consultations are typically covered, although co-pays or co-insurance may apply.

- Hospitalization: This covers inpatient care, including room and board, surgery, and other hospital services. The extent of coverage will depend on the specific plan.

- Prescription Drugs: Many plans include prescription drug coverage, but the specific drugs covered and the cost-sharing (co-pays, co-insurance) can differ significantly between plans. Some plans require you to use a specific pharmacy network.

- Preventive Care: Many plans cover preventive services like vaccinations and screenings at no cost to the insured. This is a significant benefit that can help maintain good health and prevent costly illnesses later.

- Mental Health Services: Coverage for mental health services, including therapy and medication, is becoming increasingly common, although limitations may still exist in some plans.

Potential Exclusions or Limitations

While most plans offer comprehensive coverage, it’s important to understand potential exclusions or limitations. These can significantly impact your out-of-pocket expenses. Carefully reviewing the plan documents is crucial to avoid unexpected costs.

- Pre-existing Conditions: Some plans may have limitations on coverage for pre-existing conditions, particularly in the first year of coverage. The Affordable Care Act (ACA) has significantly reduced these limitations, but it’s vital to check the specifics of each plan.

- Specific Treatments or Procedures: Certain experimental treatments or procedures may not be covered by all plans. Always verify coverage before undergoing any expensive or complex medical procedure.

- Out-of-Network Care: Using out-of-network providers typically results in higher costs, often significantly exceeding in-network rates. Understanding your plan’s out-of-network coverage is vital for managing your healthcare expenses.

- Annual and Lifetime Limits: While the ACA prohibits annual and lifetime limits on most essential health benefits, it’s still important to check the plan documents for any exceptions.

Interpreting the Summary of Benefits and Coverage (SBC)

The Summary of Benefits and Coverage (SBC) is a standardized document required by the ACA. It provides a clear and concise summary of your plan’s benefits, coverage details, and cost-sharing responsibilities. Understanding the SBC is crucial for comparing different plans effectively. The SBC typically includes information on:

- Covered Benefits: A list of the services and treatments covered by the plan.

- Cost-Sharing: Details on co-pays, co-insurance, deductibles, and out-of-pocket maximums.

- Provider Networks: Information about the doctors, hospitals, and other healthcare providers included in the plan’s network.

- Exclusions and Limitations: A clear explanation of what is not covered by the plan.

By carefully reviewing the SBC for each plan you are considering, you can make a more informed decision about which plan best meets your family’s healthcare needs and budget. Don’t hesitate to contact the insurance company or your broker if you have any questions about the information provided in the SBC.

Considering Additional Features and Riders

Choosing a family health insurance plan often involves more than just the core coverage. Many insurers offer optional add-ons, or riders, that can significantly enhance your plan’s protection and cater to your family’s specific needs. Understanding these options and their associated costs is crucial for making an informed decision. This section explores various additional features and helps you evaluate their value.

Adding riders to your base health insurance plan can provide broader coverage and peace of mind, but it’s essential to weigh the added cost against the potential benefits. Not all riders are created equal, and the value proposition will vary depending on your family’s health history, lifestyle, and financial situation. Careful consideration is key to ensuring you’re getting the most out of your insurance investment.

Dental and Vision Coverage

Dental and vision care are frequently offered as separate riders or as part of a comprehensive package. Dental riders typically cover routine checkups, cleanings, fillings, and sometimes more extensive procedures. Vision riders usually include eye exams, glasses, or contact lenses. The cost of these riders varies greatly depending on the insurer and the level of coverage offered. For instance, a basic dental rider might cover only preventative care, while a more comprehensive plan might include coverage for orthodontics.

Similarly, vision riders can range from covering basic eye exams to including significant reimbursements for laser eye surgery. Families with children, in particular, might find the value proposition of these riders particularly compelling, given the frequency of dental and vision checkups required during childhood.

Critical Illness Coverage

Critical illness riders provide a lump-sum payment upon diagnosis of a specified serious illness, such as cancer, heart attack, or stroke. This payment can help offset the financial burden associated with treatment, lost income, and other expenses. The cost of a critical illness rider will depend on the specific illnesses covered and the payout amount. For example, a plan might offer a payout of $50,000 for a heart attack, while another might offer $100,000.

The value proposition of this rider is highly dependent on individual risk assessment and financial planning. Families with a history of heart disease or cancer might find this rider particularly valuable as a safety net, while those with a lower risk profile might consider it a less necessary expense.

Choosing the right family health insurance plan can feel overwhelming, but it doesn’t have to be! Start by comparing premiums, deductibles, and co-pays across different providers. Understanding the coverage details is key, and sometimes, it feels like navigating a whole new world – much like learning to code your first “Hello world!” program, Hello world! — a seemingly simple task with underlying complexities.

Once you’ve grasped the basics, carefully consider the network of doctors and hospitals included in each plan to ensure your family’s needs are met. This will help you find the best fit for your budget and healthcare requirements.

Accidental Death and Dismemberment (AD&D) Coverage

AD&D coverage provides a lump-sum payment to your beneficiaries in the event of accidental death or loss of limb. This rider offers financial security to your family in the face of unforeseen tragedy. The cost of AD&D coverage is typically relatively low compared to other riders, but the payout can be significant, providing crucial financial support during a difficult time.

For example, a $50,000 AD&D rider might cost only a few dollars extra per month, offering considerable peace of mind for a relatively small additional premium. The value proposition here is strong for families who want to ensure financial stability for their loved ones in case of an accident.

Utilizing Online Comparison Tools

Navigating the world of family health insurance can feel like deciphering a complex code. Luckily, several online comparison tools are available to simplify the process, allowing you to efficiently compare plans side-by-side. These tools leverage technology to present key information in a clear and concise manner, saving you countless hours of manual research.Online comparison tools function by collecting data from various insurance providers and presenting it in a user-friendly format.

By inputting details such as your location, family size, and desired coverage levels, these tools filter available plans based on your specific needs. This allows for a focused comparison of premiums, deductibles, out-of-pocket maximums, and other crucial factors. You can then sort and filter results based on your priorities, making it easier to identify plans that best suit your family’s circumstances.

Key Features of Effective Comparison Websites, How to compare different health insurance plans for families

A good online comparison tool should offer several key features to ensure a comprehensive and accurate comparison. The absence of these features could lead to an incomplete understanding of the plans available.

- Detailed Plan Information: The website should provide comprehensive details for each plan, including premiums, deductibles, co-pays, out-of-pocket maximums, and covered services. Vague or incomplete information renders the tool ineffective.

- Provider Network Search: The ability to search for specific doctors and hospitals within each plan’s network is essential. This allows you to verify whether your preferred healthcare providers are included.

- Customizable Filtering Options: Robust filtering options allow users to narrow down their search based on specific criteria, such as premium range, deductible amount, and network type (HMO, PPO, etc.).

- Plan Comparison Charts: Side-by-side comparison charts allow for easy visualization of key differences between plans. This feature is crucial for quick identification of the best option for your needs.

- User Reviews and Ratings: While not always available, user reviews and ratings can offer valuable insights into the customer experience with specific insurance providers. However, it’s crucial to remember these are subjective opinions.

Limitations of Online Comparison Tools

While online comparison tools are incredibly helpful, it’s crucial to understand their limitations. Relying solely on these tools without further investigation could lead to an incomplete picture of your options.

- Data Accuracy: The accuracy of the information presented depends entirely on the data provided by the insurance companies. Inaccuracies or outdated information could lead to incorrect comparisons.

- Limited Plan Options: Some comparison websites may not include all available plans in your area, potentially overlooking a plan that perfectly suits your needs.

- Lack of Personalized Advice: These tools cannot provide personalized advice based on your unique health circumstances and family history. A conversation with an insurance broker or advisor is still recommended.

- Focus on Price: While price is a significant factor, these tools often prioritize premium costs over other crucial aspects like network adequacy or specific coverage details.

Seeking Professional Advice

Navigating the world of family health insurance can feel overwhelming, even with thorough research. The sheer volume of plans, options, and jargon can easily lead to confusion and potentially costly mistakes. This is where seeking professional guidance becomes invaluable. An independent perspective can significantly simplify the process and ensure you choose a plan that truly meets your family’s needs.Independent insurance brokers and financial advisors possess specialized knowledge and experience in navigating the complexities of health insurance.

They can provide unbiased recommendations, saving you time and effort while helping you avoid potential pitfalls.

Benefits of Consulting a Professional

Consulting a professional offers several key advantages. Firstly, they possess in-depth knowledge of various insurance plans available in your area, allowing for a comprehensive comparison beyond what you might achieve independently. Secondly, they understand the intricacies of policy language and can explain complex terms and conditions in clear, understandable language. Thirdly, they can help you identify hidden costs and potential loopholes, ensuring you’re making an informed decision based on a complete understanding of the plan’s features.

Finally, their services often save you time and reduce stress associated with the complex process of choosing a health insurance plan. Consider it an investment in peace of mind and financial security.

Questions to Ask a Professional

Before engaging a professional, prepare a list of pertinent questions. These questions should address your family’s specific healthcare needs and financial situation. For example, inquire about the suitability of different plan types (HMO, PPO, POS) based on your family’s healthcare utilization patterns. Ask for clarification on specific coverage details, such as deductibles, co-pays, and out-of-pocket maximums. Explore the network of providers offered by each plan, ensuring your preferred doctors and specialists are included.

Finally, inquire about any potential hidden costs or limitations associated with the plans under consideration. A clear understanding of these factors will allow you to make a well-informed decision.

Professional Assistance in Plan Selection

A professional can act as your guide through the entire process. They can help you analyze your family’s healthcare needs, considering factors such as pre-existing conditions, anticipated medical expenses, and preferred healthcare providers. They will then present a selection of plans that align with your requirements and budget. Their expertise extends to comparing premiums, deductibles, and out-of-pocket maximums across different plans, highlighting the cost implications of each option.

Furthermore, they can help you understand the intricacies of provider networks, ensuring your family has access to the necessary medical professionals. This comprehensive support ensures you make a well-informed decision, minimizing the risk of choosing an unsuitable plan.